The following table shows potential estimated payments to the NEOs in this Proxy Statement upon (1) voluntary termination or retirement, (2) involuntary (not for cause) or good reason termination, (3) involuntary (not for cause) or good reason termination after a change-in-control, and (4) death or disability. The table assumes that the termination was effective on the last business day of the fiscal year and contains estimates of amounts that would be paid to the NEOs upon termination in addition to the base salary and short-term incentive earned by the executives during the fiscal year. Actual amounts payable to any NEO would only be determined after an actual event of termination.

As required by SEC rules and regulations, we are providing the following information regarding the ratio of the median annual total compensation of our employees and the annual total compensation of our CEO. For fiscal year 2022:2023:

We are using a median employee that we identified for our analysis for fiscal year 2021. To identify our median employee, we began by considering everyone employed by us globally on September 3, 2021, which included approximately 6,522 employees. We then calculated total cash compensation for each employee including both current base salary and target cash incentive, and we annualized this amount for employees who commenced employment during the 2021 fiscal year. To calculate total cash compensation for any employee that we paid in currency other than U.S. Dollars, we converted to U.S. Dollars using the same exchange rate used for financial reporting purposes. We then analyzed the compensation amounts for all our employees to determine our median employee. As permitted by SEC rules and regulations, we excluded leased employees and independent contractors.There were no changes in our employee population or employee compensation arrangements that the Company believed would result in a significant change to the pay ratio disclosure.

In our analysis for fiscal year 2022, we omitted approximately 328 employees who became employees as a result of acquisitions we completed during fiscal year 2022. These2022.These employees will bewere included in fiscal year 2023 when determining whether or not a significant change occurred which would necessitate choosing a new median employee. In our analysis for fiscal year 2023, we omitted approximately 350 employees who became employees as a result of acquisitions we completed during fiscal year 2023. Based on our analysis for fiscal year 2023, we concluded that there were no changes in our employee population or employee compensation arrangements that the Company believes would result in a significant change to the pay ratio disclosure. The employees whom we omitted this year joined the Company in connection with the following acquisitions completed during fiscal year 2022:2023: Lemtapes Oy; certain assets of Tissue Seal,Aspen Research Corporation; Beardow Adams Holdings Ltd.; XChem International LLC; the stock of Fourny Group; Apollo Chemicals Limited, Apollo Roofing Solutions Limited and Apollo Construction Solutions Limited; the stock of ZKLT Polymer Materials Co., Ltd.;Adhezion Biomedical, LLC; and certain assets of GSSI Sealants, Inc.Sanglier Ltd.

For purposes of the calculation, we added together all the elements of the median employee’s compensation for fiscal year 20222023 in the same way that we calculate the annual total compensation of our NEOs (including the CEO) in the “Summary Compensation Table.”. To calculate our ratio, we divided Mr. Owens’Ms. Mastin's annual total compensation, as reported in the “Summary Compensation Table,” above, by the median employee’s annual total compensation.

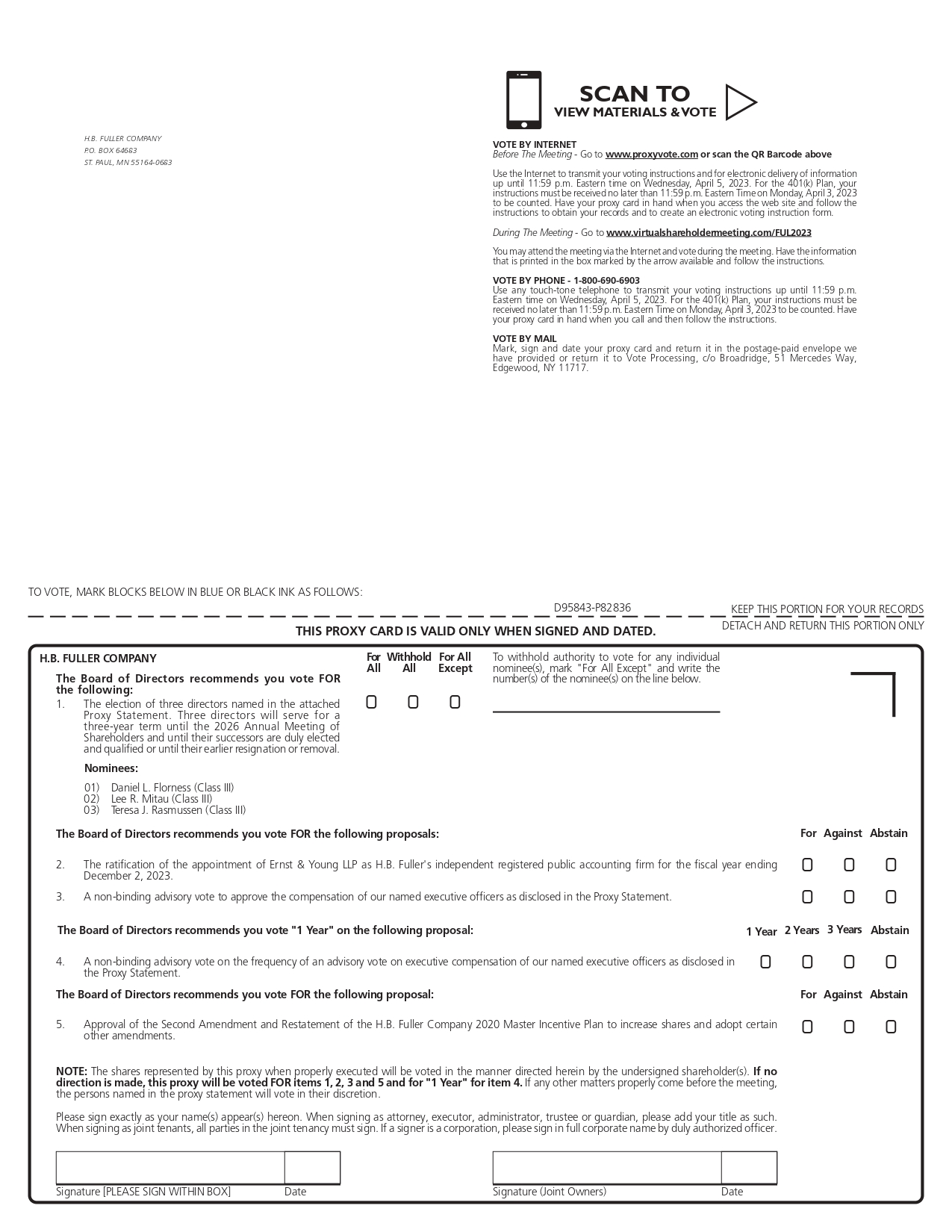

Pursuant to Section 14A of the Exchange Act, the Company is providing shareholders with an advisory (non-binding) vote on the compensation of our NEOs as disclosed in the “Compensation Discussion and Analysis” section, the tabular disclosure regarding such compensation and the accompanying narrative disclosure contained in this Proxy Statement.

The Company is asking shareholders to indicate their support for the compensation of our NEOs described in this Proxy Statement. The Company has designed its executive compensation program to attract, motivate, reward, and retain the executive talent required to achieve our corporate growth objectives and increase shareholder value. We believe that our compensation policies and procedures are centered on a pay-for-performance philosophy and are strongly aligned with the long-term interests of our shareholders.

In deciding how to vote on this proposal, the Board urges you to consider the following factors:

Accordingly, the Company is asking shareholders to vote FOR the following resolution at the Annual Meeting:

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation of the H.B. Fuller Company named executive officers, as disclosed in the “Compensation Discussion and Analysis” section, the tabular disclosure regarding such compensation, and the accompanying narrative disclosure, set forth in this Proxy Statement.”

This advisory vote on executive compensation is not binding on the Board. However, the Board will consider the result of the vote when determining future executive compensation arrangements. The Company currently conducts annual advisory votes on executive compensation.

| |

| The Board of Directors recommends a vote FOR adoption of the resolution approving the compensation of the Company’sCompany’s named executive officers, as described in the “Compensation Discussion and Analysis” section and the related tabular and narrative disclosure set forth in this Proxy Statement. |

H. B. FULLER | 2024 Proxy Statement 62

H. B. FULLER | 2023 Proxy Statement 58

|

PROPOSAL 4—NON-BINDING ADVISORY VOTE ON FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required pursuant to Section 14A of the Exchange Act, the Company is providing shareholders with an advisory (non-binding) vote on the frequency with which our shareholders shall have an advisory vote on executive compensation as provided in Proposal 3 above. By voting on this proposal, shareholders may indicate whether they would prefer an advisory vote on executive compensation once every one, two or three years. In addition, shareholders may abstain from voting. The Company is required to hold an advisory vote on frequency at least once every six years.

Starting with our annual meeting held in 2011, we have held annual advisory votes on executive compensation. The Board has determined that an advisory vote on executive compensation every year is the appropriate alternative for the Company and its shareholders. In reaching this recommendation, the Board considered that holding an annual advisory vote to approve executive compensation allows shareholders to provide direct input on the Company’s compensation philosophy, policies and practices as disclosed in the proxy statement each year. An annual advisory vote also provides the Compensation Committee with the opportunity to evaluate its compensation decisions taking into account the timely feedback provided by shareholders. In addition, the Board recognizes that an annual advisory vote to approve executive compensation is consistent with facilitating communications of shareholders with the Board and its various committees, including the Compensation Committee.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years, three years or abstain when you vote in response to the resolution set forth below:

“RESOLVED, that if no option receives the affirmative vote of a majority of the shares of common stock represented and entitled to vote, the option of once every one year, two years or three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which the Company is to hold a shareholder vote to approve the compensation of the named executive officers.”

If no option receives the affirmative vote of a majority of the shares of common stock represented and entitled to vote, the option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency for the advisory vote on executive compensation that has been selected by the shareholders.

Although the vote is non-binding, our Board of Directors will take into account the outcome of the vote when making future decisions about the frequency of the Company’s advisory votes on executive compensation.QUESTIONS AND ANSWERS ABOUT THE MEETING

|

| The Board of Directors recommends that you vote for the option of every “ONE YEAR” as the frequency with which shareholders are provided an advisory vote on the compensation of the named executive officers.

|

H. B. FULLER | 2023 Proxy Statement 59

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

PROPOSAL

We are asking our shareholders to approve the second amendment and restatement of the H.B. Fuller Company 2020 Master Incentive Plan (the “Second Amended and Restated 2020 Incentive Plan”) for two reasons:

To increase the total number of shares of common stock authorized for issuance under the 2020 Incentive Plan, from 2,500,000 shares, of which a maximum of 1,000,000 shares may be issued in the form of Full Value Awards, to 5,000,000 shares, of which a maximum of 2,000,000 shares may be issued in the form of Full Value Awards; and

•

| To extend the term of the 2020 Incentive Plan from January 21, 2031 to January 24, 2033.

| |

On January 24, 2023, our Board of Directors adopted, upon recommendation of our Compensation Committee and subject to shareholder approval, the Second Amended and Restated 2020 Incentive Plan. All capitalized terms not otherwise defined in this proposal have the meanings assigned to them in the Second Amended and Restated 2020 Incentive Plan, which is attached as Annex B to this proxy statement.

Long-term equity compensation plays an important part in the Company’s pay-for-performance philosophy. Our compensation program emphasizes stock-based compensation, encouraging our executive officers and other employees and non-employee directors to think and act as long-term shareholders.

The purpose of the Second Amended and Restated 2020 Incentive Plan is to promote the interests of the Company and our shareholders by aiding us in attracting and retaining employees, officers, consultants, independent contractors and non-employee directors capable of assuring the future success of the Company, to provide such persons with opportunities for stock ownership in the Company and to offer such persons other incentives to put forth maximum efforts for the success of the Company’s business. The Second Amended and Restated 2020 Incentive Plan will allow us to provide such persons an opportunity to acquire a proprietary interest in the Company, and align the interests of such persons with our shareholders.

The Second Amended and Restated 2020 Incentive Plan is an omnibus equity incentive plan that allows the Company to grant stock options, stock appreciation rights, restricted stock and restricted stock units, dividend equivalents and other stock-based awards to employees, officers, consultants, independent contractors and non-employee directors. The total number of shares of common stock that may be issued under all stock-based awards under the Second Amended and Restated 2020 Incentive Plan will be 5,000,000 shares. Of these authorized shares, an aggregate of 2,000,000 shares may be issued pursuant to awards other than stock options or stock appreciation rights (e.g., restricted stock and restricted stock units) (“Full Value Awards”). In addition, shares subject to any outstanding award under our prior incentive plans that, after April 6, 2023, are not purchased or are forfeited or reacquired by the Company, or otherwise not delivered to the participant due to termination or cancellation of such award, will be available for reissuance under the Second Amended and Restated 2020 Incentive Plan.

Reasons for Amending the 2020 Incentive Plan

The Second Amended and Restated 2020 Incentive Plan would increase the total number of shares of common stock authorized for issuance under the 2020 Incentive Plan, from 2,500,000 shares, of which a maximum of 1,000,000 shares may be issued in the form of Full Value Awards, to 5,000,000 shares, of which a maximum of 2,000,000 shares may be issued in the form of Full Value Awards.

We currently make awards of stock options, restricted stock units and dividend equivalents to executive officers and other employees under our 2020 Incentive Plan. As of February 6, 2023, we have 866,520 shares available under the 2020 Incentive Plan, of which a maximum of 197,798 shares may be issued in the form of Full Value Awards. We are asking our shareholders to approve the Second Amended and Restated 2020 Incentive Plan so that the Company will have an adequate number of shares authorized to make appropriate levels of stock incentive awards to officers, other employees and non-employee directors in 2023 and beyond. The Compensation Committee does not believe a sufficient number of shares of common stock remain available for issuance under the 2020 Incentive Plan for equity awards the Compensation Committee anticipates granting prior to our 2024 Annual Meeting of

H. B. FULLER | 2023 Proxy Statement 60

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Shareholders. Therefore, the Company is proposing to amend and restate the 2020 Incentive Plan to increase the total number of shares of common stock authorized for issuance. Consistent with the 2020 Incentive Plan, under the Second Amended and Restated 2020 Incentive Plan, equity awards will be made both to executive officers and other employees and to non-employee directors.

Our Board of Directors believes that the continuation of the Company’s stock-based compensation program is essential in attracting, retaining and motivating highly qualified executive officers and other employees and non-employee directors to enhance the success of the Company. As discussed above in the “Compensation Discussion and Analysis” under the caption “Fiscal 2022 Long-Term Incentive Compensation,” awards of stock options and restricted stock units (including performance-based restricted stock units) to executive officers and other employees are an essential part of this program. Unless the Second Amended and Restated 2020 Incentive Plan is adopted, the Board of Directors has concluded that the Company will need to curtail grants of stock incentive awards to executive officers, other employees and non-employee directors. The Board of Directors believes this result will have a significantly negative impact on the Company’s compensation program and objectives. Accordingly, the Board of Directors recommends approval of the Second Amended and Restated 2020 Incentive Plan in order to allow the Company to have the ability to continue to grant equity awards at competitive levels.

Since the first amendment and restatement of the 2020 Incentive Plan was approved by our shareholders on April 8, 2021, no additional awards have been or will be granted under the 2018 Incentive Plan or any predecessor plan (although all outstanding awards previously granted under previous stock incentive plans will remain outstanding and subject to the terms of these plans), and shares subject to any outstanding awards under these prior plans that are forfeited, cancelled or reacquired by the Company (including if an award otherwise terminates or is cancelled without delivery of any shares) have been and will become available for re-issuance under the Second Amended and Restated 2020 Incentive Plan.

If the Second Amended and Restated 2020 Incentive Plan is not approved by shareholders, we will continue to use the 2020 Incentive Plan in its current form as the framework for our equity incentive compensation program. However, if the authorized shares are depleted prior to its expiration date, we would not be able to continue to offer a long-term incentive program that employs equity awards, which could put us at a competitive disadvantage in recruiting and retaining talent, and also make it more difficult for us to align employee interests with those of our shareholders through a program that includes stock ownership.

Key Features of the Second Amended and Restated 2020 Incentive Plan

Consistent with the 2020 Incentive Plan, the following features of the Second Amended and Restated 2020 Incentive Plan reflect additional equity incentive plan “best practices” intended to protect the interests of our shareholders:

•

| Limit on Shares Authorized. Under the Second Amended and Restated 2020 Incentive Plan, the aggregate number of shares that may be issued is 5,000,000 shares, of which, no more than 2,000,000 shares may be issued pursuant to Full Value Awards.

| |

•

| No Evergreen Provision. The Second Amended and Restated 2020 Incentive Plan does not contain an “evergreen” provision that will automatically increase the number of shares authorized for issuance under the Second Amended and Restated 2020 Incentive Plan.

| |

•

| No Liberal Share “Recycling.” Any shares surrendered to pay the exercise price of an option or shares withheld by the Company or tendered to satisfy tax withholding obligations with respect to any award will not be added back (“recycled”) to the Second Amended and Restated 2020 Incentive Plan.

| |

•

| No Discounted Stock Options or Stock Appreciation Rights. Stock options and stock appreciation rights must have an exercise price equal to or greater than the fair market value of our common stock on the date of grant.

| |

•

| No Repricing of Stock Options or Stock Appreciation Rights. The Second Amended and Restated 2020 Incentive Plan prohibits the repricing of stock options and stock appreciation rights (including a prohibition on the repurchase of “underwater” stock options or stock appreciation rights for cash or other securities).

| |

•

| No Liberal Change in Control Definition. The Second Amended and Restated 2020 Incentive Plan prohibits any award agreement from having a change in control provision that has the effect of accelerating the exercisability of any award or the lapse of restrictions relating to any award upon only the announcement or shareholder approval (rather than the consummation of) a change in control transaction.

| |

•

| Awards Subject to Forfeiture or Clawback. Awards under the Second Amended and Restated 2020 Incentive Plan will be subject to the Company’s clawback policy, as it may be amended from time to time, and any forfeiture and penalty conditions determined by the Compensation Committee.

| |

•

| No Dividend Equivalents Paid on Unvested Awards. Under the Second Amended and Restated 2020 Incentive Plan, dividend and dividend equivalent amounts with respect to any share underlying an award may be accrued but shall not be paid until all conditions or restrictions relating to such share have been satisfied, waived or lapsed. In addition, the Second Amended and Restated 2020 Plan prohibits the granting of dividend equivalents on stock options and stock appreciation rights.

| |

H. B. FULLER | 2023 Proxy Statement 61

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Minimum Vesting Requirements. Under the Second Amended and Restated 2020 Incentive Plan, no option, stock appreciation right, restricted stock, RSU or other stock-based award shall be granted with terms providing for a vesting schedule over a period of less than one year from the date of grant, except that Company may issue the following awards that do not comply with the one year minimum exercise and vesting requirements: (i) substitute awards granted in connection with awards that are assumed, converted or substituted pursuant to a merger, acquisition or similar transaction; (ii) shares delivered in lieu of fully vested cash awards or any cash incentive compensation, provided that the performance period for such incentive compensation was at least one fiscal year; and (iii) additional awards up to a maximum of 5% of the aggregate number of shares available for issuance under the Second Amended and Restated 2020 Incentive Plan.

Annual Limit on Awards to Directors. Under the Second Amended and Restated 2020 Incentive Plan, the maximum value of all equity and cash-based compensation granted to a non-employee director cannot exceed $500,000 in any calendar year (and for this purpose equity value is determined using grant date value under applicable financial accounting rules). The independent, non-employee members of the Board may make exceptions to this limit for a non-executive chair of the Board, provided that he or she may not participate in the decision.

Independent Committee Administration. The Second Amended and Restated 2020 Incentive Plan will be administered by a committee of the Board of Directors comprised entirely of independent directors.

Determination of Increase in the Number of Shares for the Second Amended and Restated 2020 Incentive Plan

The Company has a history of conservative and disciplined share usage. In setting the proposed increase in the number of shares issuable under the Second Amended and Restated 2020 Incentive Plan, our Compensation Committee and Board considered the Company’s historical equity compensation practices (including the total number of shares underlying existing equity awards, the Company’s three-year average share usage and dilution). The Compensation Committee and the Board of Directors also considered these factors in assessing the number of shares likely to be needed for future grants.

The Second Amended and Restated 2020 Incentive Plan does not set the number of shares subject to equity awards that will be granted in future years. In setting each year’s award amounts for executive officers, the Compensation Committee considers the following: the relative market position of the awards and the total compensation for each executive, the proportion of each executive’s total compensation to be delivered as a long-term incentive award, internal pay equity, executive performance and changes in responsibility, retention concerns, and corporate performance. Similar considerations are taken into account in granting awards to participants who are not executive officers. Equity awards to non-employee directors have historically been granted at levels intended to be competitive, taking into account current market conditions.

Number of Outstanding Awards Under All Plans: As of February 6, 2023, there were 5,082,492 outstanding stock options, which had a weighted average exercise price of $52.02 and a weighted average remaining contractual life of 6.2893 years, and there were 519,097 RSU (including PSU awards) awards outstanding.

Burn Rate. Burn rate is a measure of the speed at which companies use shares available for grant under their equity compensation plans. In setting and recommending to our shareholders the increase in the number of shares to be authorized under the Second Amended and Restated 2020 Incentive Plan, the Compensation Committee and the Board of Directors considered H.B. Fuller’s net burn rate for each of the past three fiscal years. The calculation of our net burn rate is shown in the table below:

Fiscal Year | | | | | | Total | | |

2022 | | Weighted Average Shares of Common Stock Outstanding | | | | 53,580,000 | | | | | | | | | | | | | | |

| | Stock Options Granted | | | | 549,458 | | | | | | | | | | | | | | |

| | Stock Options Forfeited | | | | (40,991 | ) | | | | | | | | | | | | | |

| | Full Value Awards Granted (RSUs and PSUs) | | | | 179,603 | | | | | | | | | | | | | | |

| | Full Value Awards Forfeited | | | | (68,374 | ) | | | | | 619,696 | | | | | 1.16% | | |

| | | | | | | | | | | | | | | | | | | | |

2021 | | Weighted Average Shares of Common Stock Outstanding | | | | 52,887,000 | | | | | | | | | | | | | | |

| | Stock Options Granted | | | | 1,237,094 | | | | | | | | | | | | | | |

| | Stock Options Forfeited | | | | (1,069,886 | ) | | | | | | | | | | | | | |

| | Full Value Awards Granted (RSUs and PSUs) | | | | 356,779 | | | | | | | | | | | | | | |

| | Full Value Awards Forfeited | | | | (78,818 | ) | | | | | 445,169 | | | | | 0.84% | | |

| | | | | | | | | | | | | | | | | | | | |

2020 | | Weighted Average Shares of Common Stock Outstanding | | | | 52,039,000 | | | | | | | | | | | | | | |

| | Stock Options Granted | | | | 1,052,968 | | | | | | | | | | | | | | |

| | Stock Options Forfeited | | | | (169,907 | ) | | | | | | | | | | | | | |

| | Full Value Awards Granted (RSUs and PSUs) | | | | 216,293 | | | | | | | | | | | | | | |

| | Full Value Awards Forfeited | | | | (50,666 | ) | | | | | 1,048,688 | | | | | 2.02% | | |

| | TOTAL THREE YEAR GRANTS | | | | | | | | | | | | | | | 4.02% | | |

| | | | | | | | | | | | | | | | | | | | |

| | Three Year Average | | | | | | | | | 4.02%/3 | | | | | 1.34% | | |

| (1)

| The net burn rate is calculated by adding options and full value awards granted, less any options and full-value awards forfeited, cancelled, or expired, divided by the weighted average shares outstanding.

| |

H. B. FULLER | 2023 Proxy Statement 62

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Based on the burn rates in fiscal years 2022, 2021 and 2020, our three-year average burn rate was 1.34%.

Overhang. Total potential dilution, or overhang, is a common measure to assess the dilutive impact of equity plans. Total potential dilution is equal to (i) the number of shares available to be granted as future equity awards plus the number of shares subject to outstanding equity awards, divided by (ii) such total number of shares plus the total number of shares outstanding. Total potential dilution, prior to and after shareholder approval of the increase in shares under the Second Amended and Restated 2020 Incentive Plan, is shown in the table below:

| | Total Potential Dilution

|

Remaining Reserve under 2020 Incentive Plan (“Remaining Reserve”)1

| | | 866,520

| |

Shares Subject To Outstanding Awards under 2020 Incentive Plan and Predecessor Plans (“Granted Shares Outstanding”)1,

| | | 5,746,096

| |

Common Stock Outstanding (“CSO”)1

| | | 53,798,746

| |

Total Current Dilution2

| | | 10.9%

| |

Share Increase under Second Amended and Restated 2020 Incentive Plan (“2023 Plan Shares”)

| | | 2,500,000

| |

Total Potential Dilution3

| | | 14.5%

| |

| (1)

| As of February 6, 2023.

| |

| (2)

| Calculated as (Remaining Reserve + Granted Shares Outstanding), divided by (Remaining Reserve + Granted Shares Outstanding + CSO).

| |

| (3)

| Calculated as (Remaining Reserve + Granted Shares Outstanding + requested Share increase in 2023), divided by (Remaining Reserve + Granted Shares Outstanding + requested Share increase in 2023 + CSO).

| |

Summary of Material Terms of the Second Amended and Restated 2020 Incentive Plan

The following summary of the material terms of the Second Amended and Restated 2020 Incentive Plan is qualified in its entirety by reference to the full text of the Second Amended and Restated 2020 Incentive Plan, which is attached as Annex B to this Proxy Statement.

Administration

The Compensation Committee will administer the Second Amended and Restated 2020 Incentive Plan and will have full power and authority to determine when and to whom awards will be granted, and the type, amount, form of payment and other terms and conditions of each award, consistent with the provisions of the Second Amended and Restated 2020 Incentive Plan. In addition, the Compensation Committee can specify whether, and under what circumstances, awards to be received under the Second Amended and Restated 2020 Incentive Plan or amounts payable under such awards may be deferred automatically or at the election of either the holder of the award or the Compensation Committee. Also, the Compensation Committee can specify the manner in which the Awards are paid out under the Second Amended and Restated 2020 Incentive Plan. Subject to the provisions of the Second Amended and Restated 2020 Incentive Plan, the Compensation Committee may amend or waive the terms and conditions, or accelerate the exercisability, of an outstanding award. The Compensation Committee has authority to interpret the Second Amended and Restated 2020 Incentive Plan and establish rules and regulations for the administration of the Second Amended and Restated 2020 Incentive Plan.

The Compensation Committee may delegate to one or more officers or directors of the Company the authority to grant awards under the Second Amended and Restated 2020 Incentive Plan, except that the Compensation Committee may not delegate such authority with regard to grants to executive officers who are subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or in a way that would violate applicable rules of the Exchange Act or applicable corporate law.

The Board may also exercise the powers of the Compensation Committee at any time, so long as its actions would not violate Rule 16b-3. Only the Compensation Committee (or another committee of the Board comprised of independent directors) may grant awards to non-employee directors.

No member of the Board or the Compensation Committee or any person to whom the Compensation Committee delegates authority under the Second Amended and Restated 2020 Incentive Plan will be liable for any action or determination taken and made in good faith with respect to the Second Amended and Restated 2020 Incentive Plan or any award granted under the Second Amended and Restated 2020 Incentive Plan. Members of the Board and the Compensation Committee and each person to whom the Compensation Committee delegates authority under the Second Amended and Restated 2020 Incentive Plan will be entitled to indemnification with regard to such actions and determinations.

Shares Available for Awards and Limits on Awards

The aggregate number of shares of our common stock that may be issued under all stock-based awards made under the Second Amended and Restated 2020 Incentive Plan will be 5,000,000. Of that number, a maximum of 2,000,000 shares are available for “Full

H. B. FULLER | 2023 Proxy Statement 63

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Value Awards,” or awards other than options, stock appreciation rights and other awards the value of which is based solely on an increase in the value of the shares underlying such award after the date of grant. Shares of Common Stock that are issued under awards granted in substitution for awards previously granted by an entity that is acquired by or merged with us or one of our affiliates will not be counted against the aggregate number of shares of Common Stock available for awards under the Second Amended and Restated 2020 Incentive Plan. The Compensation Committee will not grant incentive stock options in which the aggregate fair market value of the shares with respect to which such options are exercisable for the first time by any participant during any calendar year exceeds $100,000. In addition, the maximum value of all equity and cash-based compensation granted to a non-employee director cannot exceed $500,000 in any calendar year (and for this purpose equity value is determined using grant date value under applicable financial accounting rules). The independent, non-employee members of the Board may make exceptions to this limit for a non-executive chair of the Board, provided that he or she may not participate in the decision. Furthermore, no eligible person who is an employee, officer, consultant, independent contractor, or advisor may be granted any award or awards for more than 750,000 shares in the aggregate in any calendar year.

The Compensation Committee will adjust the number of shares and share limits described above in the case of a dividend or other distribution, stock split, reverse stock split, merger or other similar corporate transaction or event that affects shares of our common stock, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be provided under the Second Amended and Restated 2020 Incentive Plan.

Eligible Participants

Any employee, officer, non-employee director, consultant, independent contractor or advisor providing services to us or any of our affiliates, or any person to whom an offer of employment or engagement with us or any of our affiliates has been made, is eligible to receive an award under the Second Amended and Restated 2020 Incentive Plan. Subject to the Second Amended and Restated 2020 Incentive Plan, the Compensation Committee will have full authority to designate which eligible persons will be granted an award. As of February 8, 2023, the record date for our 2023 Annual Meeting of Shareholders, approximately 7,141 executive officers and other employees and all eight non-employee directors would have been eligible to be selected by the Compensation Committee to receive awards under the Second Amended and Restated 2020 Incentive Plan. In fiscal year 2022, we granted awards to approximately 240 executive officers and other employees and all of our non-employee directors who were directors during fiscal year 2022.

Types of Awards and Terms and Conditions

The Second Amended and Restated 2020 Incentive Plan permits the granting of:

•

| stock options (including both incentive and non-qualified stock options);

| |

•

| stock appreciation rights;

| |

restricted stock and RSUs (including performance-based RSUs (“PSUs”);

•

| dividend equivalents; and

| |

•

| other stock-based awards.

| |

Awards may be granted alone, in addition to, in combination with or in substitution for, any other award granted under the Second Amended and Restated 2020 Incentive Plan or any other compensation plan. Awards can be granted for no cash consideration or for any cash or other consideration as may be determined by the Compensation Committee or as required by applicable law. Awards may provide that upon the grant or exercise thereof, the holder will receive cash, shares of Common Stock, other securities (but excluding promissory notes), other awards or other property, or any combination of these in a single payment, installments or on a deferred basis.

Fair Market Value. Determinations of fair market value under the Second Amended and Restated 2020 Incentive Plan will be made in accordance with methods and procedures established by the Compensation Committee. Unless otherwise determined by the Compensation Committee, the value of a share of Common Stock as of a given date will be the closing price per share of the Common Stock on the New York Stock Exchange on such date. Awards will be adjusted by the Compensation Committee in the case of a dividend (other than a regular cash dividend) or other distribution, recapitalization, stock split, reverse stock split, merger or other similar corporate transaction or event that affects shares of Common Stock, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be provided under the Second Amended and Restated 2020 Incentive Plan.

Vesting. The Second Amended and Restated 2020 Incentive Plan requires at least a one-year minimum vesting period for time-based awards and a performance period of at least one year for performance-based awards, subject to the following limited exceptions: (i) substitute awards granted in connection with awards that are assumed, converted or substituted pursuant to a merger, acquisition or similar transaction; (ii) shares delivered in lieu of fully vested cash awards or any cash incentive compensation, provided that the performance period for such incentive compensation was at least one fiscal year; and (iii) additional awards up to a maximum of 5% of the aggregate number of shares available for issuance under the Second Amended and Restated 2020 Incentive Plan.

The closing price of a share of our common stock as reported on the NYSE on February 8, 2023, the record date for our 2023 Annual Meeting of Shareholders was $72.14.

H. B. FULLER | 2023 Proxy Statement 64

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Acceleration. The Compensation Committee may provide for the acceleration of the exercisability of any award or the lapse of any restrictions relating to any award, except that no award agreement may contain a definition of change in control that has the effect of accelerating the exercisability of any award or the lapse of any restrictions relating to any award upon the announcement or shareholder approval (rather than consummation) of any reorganization, merger or consolidation of the Company, or sale or other disposition of all or substantially all of our assets.

Stock Options. The holder of an option will be entitled to purchase a number of shares of Common Stock at a specified exercise price during a specified time period, all as determined by the Compensation Committee. The exercise price per share under any stock option may not be less than the fair market value of the Common Stock on the date of grant of such option, except if such option is granted in substitution for an option previously granted by an entity that is acquired by or merged with us or one of our affiliates. Each stock option will expire no later than ten years from the date of grant. The option exercise price may be payable, at the discretion of the Compensation Committee, in cash, shares of Common Stock, other securities, other awards or other property having a fair market value on the exercise date equal to the exercise price. The Compensation Committee may also permit an option to be exercised by delivering to the participant a number of shares of Common Stock having an aggregate fair market value equal to the excess, if positive, of the fair market value of the shares underlying the option being exercised, on the date of exercise, over the exercise price of the option for such shares (being referred to as a “net exercise”). Stock options vest and become exercisable in accordance with a vesting schedule established by the Compensation Committee. In the case of a grant of an incentive stock option to a participant who, at the time of grant, possesses more than 10% of the combined voting power of all classes of our stock and our affiliates, the exercise price per share may not be less than 110% of the fair market value of the Common Stock on the date of grant, and each such incentive stock option will expire no later than five years from the date of grant. The Company does not currently grant any incentive stock options.

Stock Appreciation Rights. The holder of a stock appreciation right is entitled to receive the excess of the fair market value as of the exercise date of a specified number of shares of the Common Stock over the grant price of the stock appreciation right. The grant price of any stock appreciation right may not be less than the fair market value of the Common Stock on the date of grant of such stock appreciation right, except if such stock appreciation right is granted in substitution for a stock appreciation right previously granted by an entity that is acquired by or merged with us or one of our affiliates. Each stock appreciation right will expire no later than ten years from the date of grant. Stock appreciation rights vest and become exercisable in accordance with a vesting schedule established by the Compensation Committee. The Company does not currently grant any stock appreciation rights.

We would receive no consideration for options or stock appreciation rights granted under the Second Amended and Restated 2020 Incentive Plan, other than the services rendered by the holder in his or her capacity as employee, officer, non-employee director, consultant, independent contractor or advisor providing services to us or any of our affiliates, or the promise of services from any person to whom an offer of employment or engagement with us or any of our affiliates is made.

Restricted Stock and Restricted Stock Units. The holder of restricted stock will own shares of our common stock subject to restrictions imposed by the Compensation Committee (including, for example, restrictions on the right to transfer, the right to vote the restricted shares or to receive any dividends with respect to the shares) for a specified time period determined by the Compensation Committee. The holder of RSUs will have the right, subject to any restrictions imposed by the Compensation Committee, to receive shares of Common Stock, or a cash payment equal to the fair market value of those shares, at some future date determined by the Compensation Committee. The Company does not currently grant any restricted stock.

Dividend Equivalents. The holder of a dividend equivalent will be entitled to receive payments (in cash, shares of our common stock, other securities, other awards or other property) equivalent to the amount of cash dividends paid by us to the holders of Common Stock, with respect to the number of shares determined by the Compensation Committee. Dividend equivalents will be subject to other terms and conditions determined by the Compensation Committee, but the Compensation Committee may not grant dividend equivalents to a participant in connection with grants of options, stock appreciation rights or other awards the value of which is based is solely on an increase in the value of our common stock after the grant of such award. Dividend equivalent amounts with respect to any share underlying any other award may be accrued but shall not be paid until all conditions or restrictions relating to such share have been satisfied, waived or lapsed.

Other Stock-Based Awards. The Compensation Committee is also authorized to grant other types of awards that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to shares of Common Stock, subject to terms and conditions determined by the Compensation Committee and the limitations in the Second Amended and Restated 2020 Incentive Plan. No such other stock-based award can contain a purchase right or an option-like feature.

Counting Shares

If an award entitles the holder to receive or purchase shares of our common stock, the shares covered by such award or to which the award relates will be counted against the aggregate number of shares available for awards under the Second Amended and Restated 2020 Incentive Plan. Awards that do not entitle the holder to receive or purchase shares, and shares issued under awards granted in substitution for awards previously granted by an entity that is acquired by or merged with us or one of our affiliates, will not be counted against the aggregate number of shares available for awards under the Second Amended and Restated 2020 Incentive Plan.

In general, if shares covered by an award are not purchased or are forfeited or are reacquired by us, or if an award otherwise terminates or is cancelled without delivery of any shares, then the number of shares counted against the aggregate number of shares available under the Second Amended and Restated 2020 Incentive Plan with respect to such award, to the extent of any such

H. B. FULLER | 2023 Proxy Statement 65

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

forfeiture, reacquisition by us, termination or cancellation, will again be available for future awards under the Second Amended and Restated 2020 Incentive Plan. Notwithstanding the foregoing, shares withheld as payment of the purchase or exercise price of an award or in satisfaction of tax obligations relating to an award, shares covered by a stock-settled stock appreciation right that are not issued in connection with settlement in shares upon exercise, and shares repurchased by us using option exercise proceeds, will not be available again for granting awards under the Second Amended and Restated 2020 Incentive Plan.

Amendment and Termination

The Second Amended and Restated 2020 Incentive Plan will terminate on January 24, 2033, unless earlier terminated by the Board. No awards may be made after that date. Unless otherwise expressly provided in an applicable award agreement, any award granted under the Second Amended and Restated 2020 Incentive Plan prior to expiration may extend beyond the expiration of the Second Amended and Restated 2020 Incentive Plan through the award’s normal expiration date.

The Board may amend, alter, suspend, discontinue or terminate the Second Amended and Restated 2020 Incentive Plan at any time, although shareholder approval must be obtained for any amendment to the Second Amended and Restated 2020 Incentive Plan that would (1) increase the number of shares of Common Stock available for issuance under the Second Amended and Restated 2020 Incentive Plan, (2) increase the award limits under the Second Amended and Restated 2020 Incentive Plan, (3) permit repricing of options or stock appreciation rights, (4) increase the maximum term permitted for options or stock appreciation rights under the Second Amended and Restated 2020 Incentive Plan, (5) permit awards of options or stock appreciation rights at a price less than fair market value (other than as permitted under the Second Amended and Restated 2020 Incentive Plan), or (6) cause us to be unable to grant incentive stock options under the Second Amended and Restated 2020 Incentive Plan. Shareholder approval is also required for any action that requires shareholder approval under the rules and regulations of the SEC, the NYSE or any other securities exchange that are applicable to us. The Compensation Committee may amend the Second Amended and Restated 2020 Incentive Plan, without prior approval of our shareholders, to comply with any changes in tax law impacting the tax deductibility of awards under the Second Amended and Restated 2020 Incentive Plan to the extent such amendments are for the purpose of maximizing the tax deductibility of awards.

Prohibition on Repricing Awards

Without the approval of our shareholders, the Compensation Committee will not reprice, adjust or amend the exercise price of any option or the grant price of any stock appreciation right previously awarded, whether through amendment, cancellation, repurchase and replacement grant or any other means, except in connection with a dividend (other than a regular cash dividend) or other distribution, stock split, reverse stock split, merger or other similar corporate transaction or event that affects shares of our common stock, in order to prevent dilution or enlargement of the benefits, or potential benefits intended to be provided under the Second Amended and Restated 2020 Incentive Plan.

Clawback or Recoupment

All awards under the Second Amended and Restated 2020 Incentive Plan will be subject to forfeiture or other penalties pursuant to the Company’s clawback policy and such forfeiture and penalty provisions as are determined by the Compensation Committee and any amendments to such clawback policy as may be adopted from time to time by the Compensation Committee.

Certain Corporate Events

In the event of certain corporate transactions or events involving the Company, including any reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of shares of our common stock or other securities, or if we enter into a written agreement to undergo such a transaction or event, the Compensation Committee or our Board will have the authority, with respect to any awards under the Second Amended and Restated 2020 Incentive Plan and subject to the terms of the Second Amended and Restated 2020 Incentive Plan, to provide for any of the following to be effective upon consummation of the event (i) either terminate such awards, whether or not vested, in exchange for an amount of cash and/or other property, if any, equal to the amount that would have been attained upon the exercise of the vested portion of such award or realization of the participant’s vested rights, or replace such awards with other rights or property selected by the Compensation Committee or the Board, (ii) provide that such awards will be assumed by the successor or survivor corporation, or a parent or subsidiary of the successor or surviving corporation, or substituted for by similar options, rights or awards covering the stock of the successor or survivor corporation, or a parent or subsidiary thereof, with appropriate adjustments as to the number and kind of shares and prices, (iii) accelerate such awards, or (iv) provide that such awards cannot vest, be exercised or become payable after a date certain in the future, which may be the effective date of such event.

Transferability of Awards

Generally, no award or other right or interest of a participant under the Second Amended and Restated 2020 Incentive Plan (other than fully vested and unrestricted shares issued pursuant to an award) shall be transferable by a participant other than by will or by the laws of descent and distribution, and no right or award may be pledged, alienated, attached or otherwise encumbered, and any purported pledge, alienation, attachment or encumbrance shall be void and unenforceable against the Company or any affiliates. However, the Committee may allow transfer of an award to family members for no value, and such transfer shall comply with the General Instructions to Form S-8 under the Securities Act of 1933, as amended. The Committee may also establish procedures to allow a named beneficiary to exercise the rights of the participant and receive any property distributable with respect to any award upon the participant’s death.

H. B. FULLER | 2023 Proxy Statement 66

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Federal Income Tax Consequences

Grant of Options and Stock Appreciation Rights. The grant of a stock option (either an incentive stock option or a non-qualified stock option) or stock appreciation right is not expected to result in any taxable income for the recipient.

Exercise of Incentive Stock Options. No taxable income is realized by the optionee upon the exercise of an incentive stock option. If stock is issued to the optionee pursuant to the exercise of an incentive stock option, and if no disqualifying disposition of such shares is made by such award holder within two years after the date of grant or within one year after the transfer of such shares to such award holder, then (1) upon the sale of such shares, any amount realized in excess of the option price will be taxed to such optionee as a long-term capital gain and any loss sustained will be a long-term capital loss, and (2) we will not be entitled to a deduction for federal income tax purposes.

If the stock acquired upon the exercise of an incentive stock option is disposed of prior to the expiration of either holding period described above, generally (1) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such shares at exercise (or, if less, the amount realized on the disposition of such shares) over the option price paid for such shares, and (2) we generally will be entitled to deduct such amount for federal income tax purposes if the amount represents an ordinary and necessary business expense. Any further gain (or loss) realized by the optionee will be taxed as short-term or long-term capital gain (or loss), as the case may be, and will not result in any deduction by us.

Exercise of Non-Qualified Stock Options and Stock Appreciation Rights. Upon exercising a non-qualified stock option, the optionee must recognize ordinary income equal to the excess of the fair market value of the shares of our common stock acquired on the date of exercise over the exercise price, and we generally will be entitled at that time to an income tax deduction for the same amount. Upon exercising a stock appreciation right, the amount of any cash received and the fair market value on the exercise date of any shares of our common stock received are taxable to the recipient as ordinary income and generally are deductible by us.

The tax consequence upon a disposition of shares acquired through the exercise of a non-qualified stock option or stock appreciation right will depend on how long the shares have been held. Generally, there will be no tax consequence to us in connection with the disposition of shares acquired under a non-qualified stock option or stock appreciation right.

Restricted Stock. Recipients of grants of restricted stock generally will be required to include as taxable ordinary income the fair market value of the restricted stock at the time it is no longer subject to a substantial risk of forfeiture. However, an award holder who makes an 83(b) election within 30 days of the date of grant of the restricted stock will incur taxable ordinary income on the date of grant equal to the fair market value of such shares of restricted stock (determined without regard to forfeiture restrictions). With respect to the sale of shares after the forfeiture restrictions have expired, the holding period to determine whether the award recipient has long-term or short-term capital gain or loss generally begins when the restrictions expire, and the tax basis for such shares will generally be based on the fair market value of the shares on that date. However, if the award holder made an 83(b) election as described above, the holding period commences on the date of such election, and the tax basis will be equal to the fair market value of the shares on the date of the election (determined without regard to the forfeiture restrictions on the shares). Dividends, if any, that are accrued while the restricted stock is subject to a substantial risk of forfeiture will also be taxed as ordinary income. We generally will be entitled to an income tax deduction equal to amounts the award holder includes in ordinary income at the time of such income inclusion.

Restricted Stock Units and Other Stock-Based Awards. Recipients of grants of restricted stock units will not incur any federal income tax liability at the time the awards are granted. Award holders will recognize ordinary income equal to (a) the amount of cash received under the terms of the award or, as applicable, (b) the fair market value of the shares received (determined as of the date of receipt) under the terms of the award. Dividend equivalents accrued with respect to any award will also be taxed as ordinary income if and when paid. Cash or shares to be received pursuant to any other deferred payment award generally become payable when applicable forfeiture restrictions lapse; provided, however, that, if the terms of the award so provide, payment may be delayed until a later date to the extent permitted under applicable tax laws. We generally will be entitled to an income tax deduction for any amounts included by the award holder as ordinary income. For awards that are payable in shares, the participant’s tax basis is equal to the fair market value of the shares at the time the shares become payable. Upon the sale of the shares, appreciation (or depreciation) after the shares are paid is treated as either short-term or long-term capital gain (or loss) depending on how long the shares have been held.

Income Tax Deduction. Subject to the usual rules concerning reasonable compensation, including our obligation to withhold or otherwise collect certain income and payroll taxes, we generally will be entitled to a corresponding income tax deduction at the time a participant recognizes ordinary income from awards made under the Second Amended and Restated 2020 Incentive Plan. However, Section 162(m) of the Code prohibits publicly held corporations from deducting more than $1 million per year in compensation paid to certain named executive officers. Therefore, compensation paid to a covered executive in any given year in excess of $1 million will not be deductible.

Special Rules for Executive Officers Subject to Section 16 of the Exchange Act. Special rules may apply to individuals subject to Section 16 of the Exchange Act. In particular, unless a special election is made pursuant to the Code, shares received through the exercise of a stock option or stock appreciation right may be treated as restricted as to transferability and subject to a substantial risk of forfeiture for a period of up to six months after the date of exercise. Accordingly, the amount of any ordinary income recognized and the amount of our income tax deduction will be determined as of the end of that period.

H. B. FULLER | 2023 Proxy Statement 67

|

PROPOSAL 5—APPROVAL OF THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS

Section 409A of the Internal Revenue Code. The Compensation Committee will administer and interpret the Second Amended and Restated 2020 Incentive Plan and all award agreements in a manner consistent with the intent to satisfy the requirements of Section 409A of the Code to avoid any adverse tax results thereunder to a holder of an award. If any provision of the Second Amended and Restated 2020 Incentive Plan or any award agreement would result in such adverse consequences, the Compensation Committee may amend that provision or take other necessary action to avoid any adverse tax results, and no such action will be deemed to impair or otherwise adversely affect the rights of any holder of an award under the Second Amended and Restated 2020 Incentive Plan.

New Plan Benefits

No benefits or amounts have been granted, awarded or received under the Second Amended and Restated 2020 Incentive Plan, as the amendments to the 2020 Incentive Plan will only take effect upon shareholder approval. In addition, the Compensation Committee, in its sole discretion, will determine the number and types of awards that will be granted under the Second Amended and Restated 2020 Incentive Plan. Accordingly, it is not possible to determine the benefits that will be received by eligible participants if the Second Amended and Restated 2020 Incentive Plan is approved by our shareholders.

|

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE PROPOSAL TO APPROVE THE SECOND AMENDMENT AND RESTATEMENT OF THE H.B. FULLER COMPANY 2020 MASTER INCENTIVE PLAN TO INCREASE SHARES AND ADOPT CERTAIN OTHER AMENDMENTS. PROXIES WILL BE VOTED FOR THE PROPOSAL UNLESS OTHERWISE SPECIFIED.

|

Equity Compensation Plan Information

The following table summarizes information regarding our equity compensation plans as of December 2, 2022, the last trading day of our most recently completed fiscal year.

Period | | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | | (b) Weighted- average exercise price of outstanding options, warrants and rights | | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders | | | 5,314,1901 | | | | $ | 51.212 | | | | 1,268,6083 | |

Equity compensation plans not approved by security holders | | | - | | | | | N/A | | | | - | |

Total | | | 5,314,190 | | | | $ | 51.21 | | | | 1,268,608 | |

(1)

| Consists of outstanding stock options to acquire 4,823,070 shares of common stock, 284,178 outstanding time-based restricted stock units and 206,942 outstanding performance-based restricted stock units granted under the Company's equity compensation plans.

|

(2)

| Consists of the weighted average exercise price of stock options granted under the Company's equity compensation plans.

|

(3)

| Number of shares of common stock remaining available for future issuance under the Amended and Restated H.B. Fuller Company 2020 Master Incentive Plan.

|

H. B. FULLER | 2023 Proxy Statement 68

|

QUESTIONS AND ANSWERS

ABOUT THE MEETING

What is the purpose of the meeting?

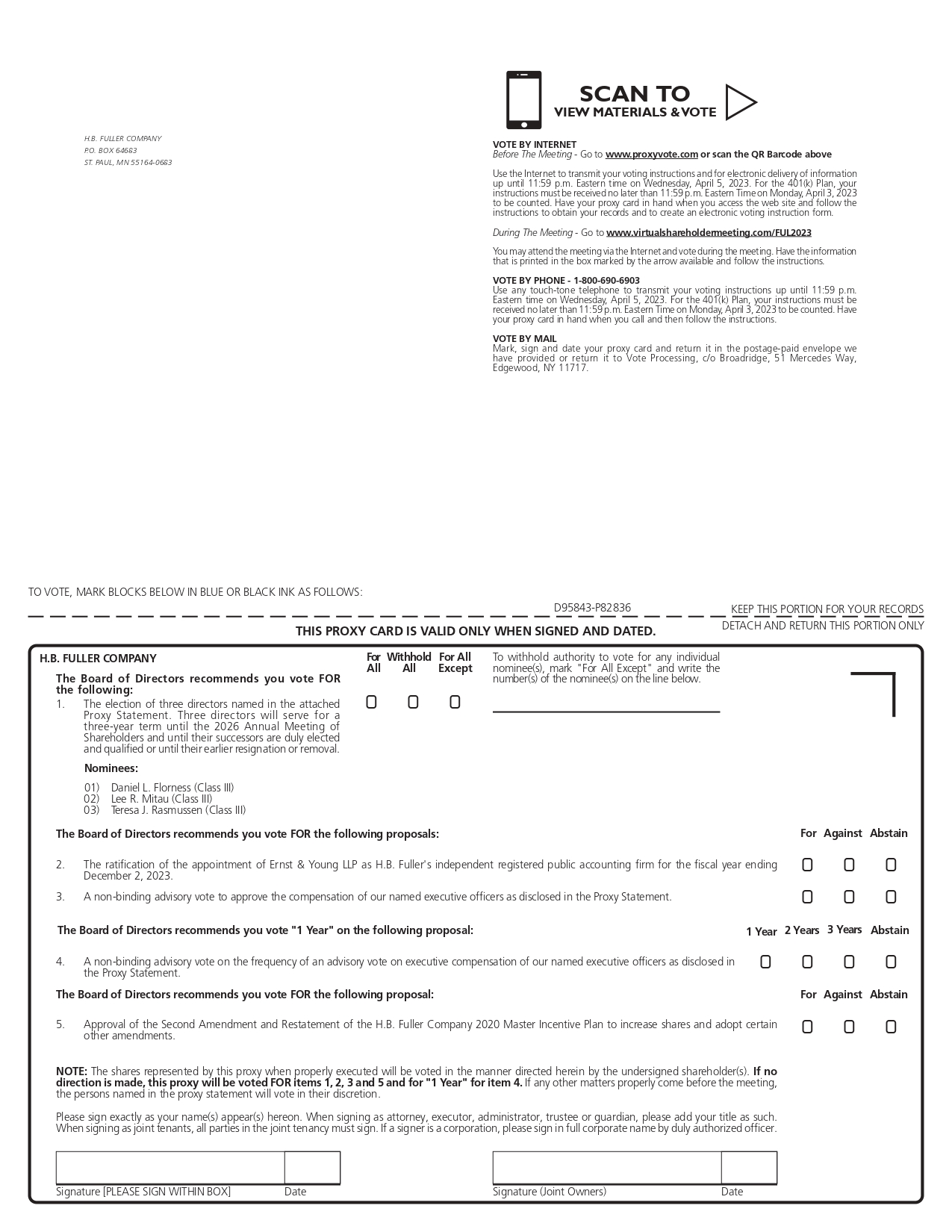

At our Annual Meeting, shareholders will act upon the matters disclosed in the Notice of Annual Meeting of Shareholders that accompanies this Proxy Statement. These matters include the election of three directors, the ratification of the appointment of our independent registered public accounting firm, and a non-binding advisory vote to approve the compensation of our named executive officers as disclosed in this Proxy Statement (the “Say on Pay Proposal”), a non-binding advisory vote on the frequency of an advisory vote on executive compensation (the “Frequency of Say on Pay Proposal”), and the second amendment and restatement of the H.B. Fuller Company 2020 Master Incentive Plan to increase the number of shares of common stock authorized for issuance under the Plan by 2,500,000 shares, and to adopt certain other amendments to the Plan..

How can I attend the virtual meeting and vote my shares during the meeting?

If you are a shareholder of record, you may attend the meeting and vote your shares electronically during the virtual meeting by visiting www.virtualshareholdermeeting.com/FUL2023FUL2024. You will need the 16-digit control number that is printed in the box marked by the arrow on your Notice Regarding the Availability of Proxy Materials to enter the Annual Meeting. We recommend that you log in at least 15 minutes before the meeting to ensure that you are logged in when the meeting starts. However, even if you currently plan to attend the virtual meeting, we recommend that you submit your proxy ahead of time so that your vote will be counted if, for whatever reason, you later decide to not attend the virtual meeting.

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page. The virtual meeting website will also present an option for you to attend the Annual Meeting as a guest without logging in, but guests will not be able to vote during the Annual Meeting.

If you are a participant in the 401(k) Plan, you may submit a proxy vote as described above, but you may not vote your 401(k) Plan shares in those plans during the virtual meeting.

How will management respond to questions during the virtual meeting?

The Company has held its Annual Meeting of Shareholders as a virtual meeting webcast via the Internet since 2016. While our Annual Meeting is just one of the forums where we engage with shareholders, it is an important one. The Board believes that holding the Annual Meeting in a virtual format provides the opportunity for participation by a broader group of shareholders, while reducing the costs and environmental impact associated with planning, holding, and arranging logistics for an in-person meeting. We welcome your suggestions on how we can improve our virtual meeting and make it more effective and efficient.

Management will respond to questions from shareholders in the same way as it would if the Company held an in-person meeting. Shareholders who wish to submit a question to the Company for the meeting may do so in advance at www.proxyvote.com and live during the meeting at www.virtualshareholdermeeting.com/FUL2023FUL2024. You will need the 16-digit control number that is printed in the box marked by the arrow on your Notice Regarding the Availability of Proxy Materials to enter the Annual Meeting. We recommend that you log in at least 15 minutes before the meeting to ensure that you are logged in when the meeting starts.

We intend that the virtual meeting format provide shareholders a level of participation and transparency as close as possible to the traditional in-person meeting format, and we take the following steps to ensure such an experience:

providing shareholders with the ability to submit appropriate questions in advance of the meeting to ensure thoughtful responses from management and the Board;

● | providing shareholders with the ability to submit appropriate questions in advance of the meeting to ensure thoughtful responses from management and the Board; |

providing shareholders with the ability to submit appropriate questions real-time, limiting questions to one per shareholder unless time otherwise permits;

● | providing shareholders with the ability to submit appropriate questions real-time, limiting questions to one per shareholder unless time otherwise permits; |

H. B. FULLER | 2024 Proxy Statement 63

H. B. FULLER | 2023 Proxy Statement 69

|

QUESTIONS AND ANSWERS ABOUT THE MEETING

● | answering as many questions as possible in the time allotted for the meeting (the question-and-answer session will be limited to 15 minutes), without discrimination, if the questions are submitted in accordance with the meeting rules of conduct (for example, the Company does not intend to answer questions that are irrelevant to the business of the Company or to the business of the Annual Meeting); |

answering as many questions as possible in the time allotted for the meeting (the question-and-answer session will be limited to 15 minutes), without discrimination, if the questions are submitted in accordance with the meeting rules of conduct (for example, the Company does not intend to answer questions that are irrelevant to the business of the Company or to the business of the Annual Meeting);

● | if there are appropriate questions that we cannot answer during the meeting, we will post the questions and answers thereto on www.hbfuller.com in the Investor Relations area of our website; and |

if there are appropriate questions that we cannot answer during the meeting, we will post the questions and answers thereto on www.hbfuller.com in the Investor Relations area of our website; and

● | offering separate engagement opportunities with shareholders on appropriate matters of governance or other relevant topics as outlined under the “Communications with Directors” section on page 19 in this Proxy Statement. |

offering separate engagement opportunities with shareholders on appropriate matters of governance or other relevant topics as outlined under the “Communications with Directors” section on page 19 in this Proxy Statement.

How does the Board recommend that I vote?

The Board of Directors recommends a vote “FOR” each of the nominees for director, “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 2, 2023,November 30, 2024, and “FOR” the Say on Pay Proposal, for the “ONE YEAR” frequency for the Frequency of Say on Pay Proposal, and “FOR” the second amendment and restatement of the H.B. Fuller Company 2020 Master Incentive Plan.Proposal.

Who is entitled to vote at the meeting?

If you were a shareholder of record at the close of business on February 8, 2023,14, 2024, you are entitled to vote at the meeting.

As of the record date, 53,799,90654,435,548 shares of common stock of the Company were outstanding and eligible to vote.

What is the difference between a shareholder of record and a street name holder?

If your shares are registered directly in your name, you are considered the “shareholder of record” with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of those shares, and your shares are held in street name.

What are the voting rights of the shareholders?

Holders of common stock are entitled to one vote per share. Therefore, a total of 53,799,90654,435,548 votes are entitled to be cast at the meeting. There is no cumulative voting for the election of directors.

How many shares must be present to hold the meeting?

A quorum is necessary to hold the meeting and conduct business. The presence of shareholders who can direct the voting of at least a majority of the outstanding shares of Common Stock as of the record date is considered a quorum. A shareholder is counted as present at the meeting if the shareholder logs in to the virtual meeting and votes at the meeting or if the shareholder has properly submitted a proxy by mail, telephone, or Internet.

How do I vote my shares?

You may give a proxy to be voted at the meeting either:

by Internet or telephone, by following the instructions provided in the Notice of Internet Availability of Proxy Materials or proxy card; or

● | by Internet or telephone, by following the instructions provided in the Notice of Internet Availability of Proxy Materials, or proxy card; or |

if you received printed proxy materials, you may also vote by Internet, mail or telephone as instructed on the proxy card, or if you hold shares beneficially in street name, the voting instruction card provided to you by your broker, bank, trustee, or nominee.

● | if you received printed proxy materials, you may also vote by Internet, mail, or telephone as instructed on the proxy card, or if you hold shares beneficially in street name, the voting instruction card provided to you by your broker, bank, trustee, or nominee. |

The telephone and Internet voting procedures have been set up for your convenience. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly.

H. B. FULLER | 2023 Proxy Statement 70

|

QUESTIONS AND ANSWERS ABOUT THE MEETING

You may also vote at the virtual meeting as described in “How can I attend thevirtual meeting and vote my shares during the meeting?” above.

H. B. FULLER | 2024 Proxy Statement 64

QUESTIONS AND ANSWERS ABOUT THE MEETING

If you hold any shares of common stock in the 401(k) Plan, you are being provided access to the same proxy materials as any other shareholder of record. However, your proxy vote will serve as voting instructions to the plan trustee. The shares held in the 401(k) Plan will be voted by the applicable plan trustee.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials, proxy card or voting instruction card?

It means you hold shares of common stock in more than one account. To ensure that all your shares are voted, sign and return each proxy card or voting instruction card or, if you vote by telephone or via the Internet, vote once for each proxy card, voting instruction card, or Notice of Internet Availability of Proxy Materials you receive.

What vote is required for the proposals to be approved?

Each director is elected by a plurality of the votes cast, meaning that the three nominees receiving the most votes will be elected. However, in an uncontested election, if a nominee for director receives a greater number of votes “WITHHELD’“WITHHELD" from his or her election than votes “FOR” such election, the director shall submit to the Board a letter of resignation for consideration. See the heading “Director Elections” in the “Corporate Governance” section of this Proxy Statement for more information. With respect to the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm and the Say On Pay Proposal, and the second amendment and restatement of the H.B. Fuller Company 2020 Master Incentive Plan, the affirmative vote of a majority of the shares of common stock represented and entitled to vote on each proposal is required, provided that the total number of shares of common stock that vote in favor of the proposal represents more than 25% of the shares outstanding on the record date.With respect to the Frequency of Say on Pay Proposal, if no option receives the affirmative vote of a majority of the shares of common stock represented and entitled to vote, the frequency selected by shareholders will be determined based on a plurality of the votes cast. This means that the option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency that has been selected by shareholders.

How are votes counted?

Shareholders may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for election to the Board. Shareholders may vote “FOR,” “AGAINST”“AGAINST,” or “ABSTAIN” on the ratification of the appointment of Ernst & Young LLP the Say on Pay Proposal and the second amendment and restatement of the H.B. Fuller Company 2020 Master Incentive Plan. Shareholders may vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS” or “ABSTAIN” on the Frequency of Say on Pay Proposal.

If you vote ABSTAIN"ABSTAIN" or WITHHOLD,"WITHHOLD," your shares will be counted as present at the meeting for the purposes of determining a quorum. If you ABSTAIN from voting on the Frequency of Say on Pay Proposal, and the frequency selected by shareholders is determined based on a plurality of the votes cast, this will have no effect on the frequency that is selected by shareholders. Otherwise, if you ABSTAIN"ABSTAIN" from voting on any proposal, your abstention has the same effect as a vote against that proposal. If you WITHHOLD"WITHHOLD" authority to vote for one or more of the nominees for director, this withholding of authority to vote will have no effect on the election of any director from whom votes are withheld, unless the director receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” such election, in which case the director shall submit to the Board a letter of resignation for consideration. See the heading “Director Elections” in the “Corporate Governance” section of this Proxy Statement for more information.

If you hold your shares in street name and do not provide voting instructions to your broker or nominee, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker or nominee does not have discretionary authority to vote under the rules of the NYSE. Shares that constitute broker non-votes will be present at the meeting for the purpose of determining a quorum but are not considered entitled to vote on the proposal in question. Your broker or nominee has discretionary authority to vote your shares on the ratification of Ernst & Young as our independent registered public accounting firm even if your broker or nominee does not receive voting instructions from you. Your broker or nominee may not vote your shares on the election of directors or the Say on Pay Proposal the Frequency of Say on Pay Proposal and the second amendment and restatement of the H.B. Fuller Company 2020 Master Incentive Plan unless it receives voting instructions from you. Broker non-votes will generally have no effect in determining whether any proposals to be voted on at the meeting are approved.

H. B. FULLER | 2023 Proxy Statement 71

|

QUESTIONS AND ANSWERS ABOUT THE MEETING

What if I do not specify how I want my shares voted?

If you do not specify on your returned proxy card or voting instruction card (or when giving your proxy by telephone or via the Internet) how you want to vote your shares, we will vote them:

● | FOR all the nominees for director; |

● | FOR the ratification of the appointment of Ernst & Young as our independent registered public accounting firm for fiscal year ending November 30, 2024; |

● | FOR the Say on Pay Proposal; and |

● | with respect to such other matters that may properly come before the meeting, in accordance with the judgment of the persons named as proxies. |

H. B. FULLER | 2024 Proxy Statement 65

FOR all the nominees for director;

FOR the Say on Pay Proposal;

FOR “ONE YEAR” for the Frequency of Say on Pay Proposal;

“FOR” the second amendment and restatement of the 2020 Incentive Plan; and

with respect to such other matters that may properly come before the meeting, in accordance with the judgment of the persons named as proxies.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Can I change my vote?

Yes. If you are a shareholder of record, you may change your vote and revoke your proxy at any time before it is voted at the virtual meeting in any of the following ways:

by sending a written notice of revocation to our Corporate Secretary;

● | by sending a written notice of revocation to our Corporate Secretary; |

by submitting another properly signed proxy card later to our Corporate Secretary;

● | by submitting another properly signed proxy card later to our Corporate Secretary; |

by submitting another proxy by telephone or via the Internet later; or

● | by submitting another proxy by telephone or via the Internet later; or |

by voting electronically at the virtual meeting.

● | by voting electronically at the virtual meeting. |

If you are a street name holder, please consult your broker, bank, trustee, or nominee for instructions on how to change your vote.

Who pays for the cost of proxy preparation and solicitation?